Consumer fraud losses jumped 25% in 2024 to over $12.5 billion, with investment scams accounting for $5.7 billion (ABA Banking Journal and Federal Trade Commission). Research shows that 17% of digital bank statements used for loan applications worldwide have been tampered with, and 15% of company registration certificates submitted for corporate account opening are fake (Google Cloud).

Financial institutions now face a reality where manual document verification cannot keep pace with sophisticated fraud tactics.

Traditional document processing focuses on data extraction. But what happens when the document itself is fraudulent?

- How do you detect a bank statement where amounts have been digitally altered without visible traces?

- Can your current system identify PDF documents that have been modified after signing using incremental updates?

- Are you catching copy-move forgeries where fraudsters duplicate legitimate content to hide manipulations?

Document fraud costs businesses billions annually. The problem isn’t just financial loss—it’s reputational damage, regulatory penalties, and compromised customer trust. Organizations need solutions that validate document authenticity before extracting data. This is where document forensics transforms risk management from reactive detection to proactive prevention.

Key Takeaways

- KlearStack’s Document Forensics engine performs deep analysis at both pixel and structural levels to identify document manipulations invisible to human reviewers

- The platform combines PDF structural forensics with advanced image-level checks including ELA, noise variance analysis, and copy-move detection for comprehensive fraud prevention

- Real-time authentication happens in under 3 seconds per document, processing thousands daily while maintaining 99% accuracy across multiple document formats

- Organizations using document forensics reduce manual fraud reviews by 52 minutes per case and detect up to 32% more fraud than traditional verification methods

- The solution provides forensic-grade evidence with explainable AI verdicts that meet regulatory requirements for KYC, AML, GDPR, and DORA compliance

- Multi-layered detection catches template farms, serial fraud patterns, and sophisticated editing techniques including metadata manipulation and transparency layer abuse

- Integration with existing IDP workflows means fraud prevention happens at intake, stopping fraudulent documents before they enter business processes

What Is Document Forensics in Intelligent Document Processing?

Document forensics represents the next evolution in intelligent document processing. Traditional IDP extracts data from documents. Document forensics validates that documents are authentic before extraction begins.

Think of it as the difference between reading a letter and verifying the letter wasn’t forged. Both matter, but authenticity comes first.

The Dual-Layer Analysis Approach

KlearStack’s Document Forensics engine analyzes documents at two critical levels:

Layer 1: Structural Integrity Analysis

- PDF fonts and encoding patterns

- Transparency layers and optional content groups

- Metadata and document properties

- Incremental update chains and revision history

Layer 2: Pixel-Level Image Analysis

- JPEG compression artifacts and inconsistencies

- Noise pattern distribution across regions

- Edge consistency and boundary detection

- Frequency domain analysis using DCT coefficients

This dual approach catches manipulations that single-method systems miss. The technology uses AI trained on millions of documents. It learns fraud patterns, adapts to new techniques, and provides explainable verdicts.

Why Traditional OCR and IDP Fall Short

Standard OCR reads text from documents. Basic IDP adds classification and data extraction. Neither validates authenticity. A perfectly forged document with altered amounts will pass through these systems without triggering alerts.

Manual review cannot scale. Fraudsters create forgeries so sophisticated that trained reviewers miss them. The average cost of fraud for financial institutions reached $4.3 million per incident in 2024, including investigation, recovery, and regulatory fines, according to CoinLaw. Prevention costs less than remediation.

The Document Forensics Difference

Document forensics sits at the intersection of security and automation. It protects your business while maintaining processing speed. Every document gets authenticated in real-time. Suspicious files get flagged instantly. Clean documents proceed to extraction without delays.

Organizations using document forensics report measurable improvements. Companies like Payoneer reduced manual fraud reviews to just 18% of intake, with customer approval representatives agreeing with AI verdicts 99.2% of the time (Google Cloud). The technology stops hundreds of serial fraud attempts daily at onboarding.

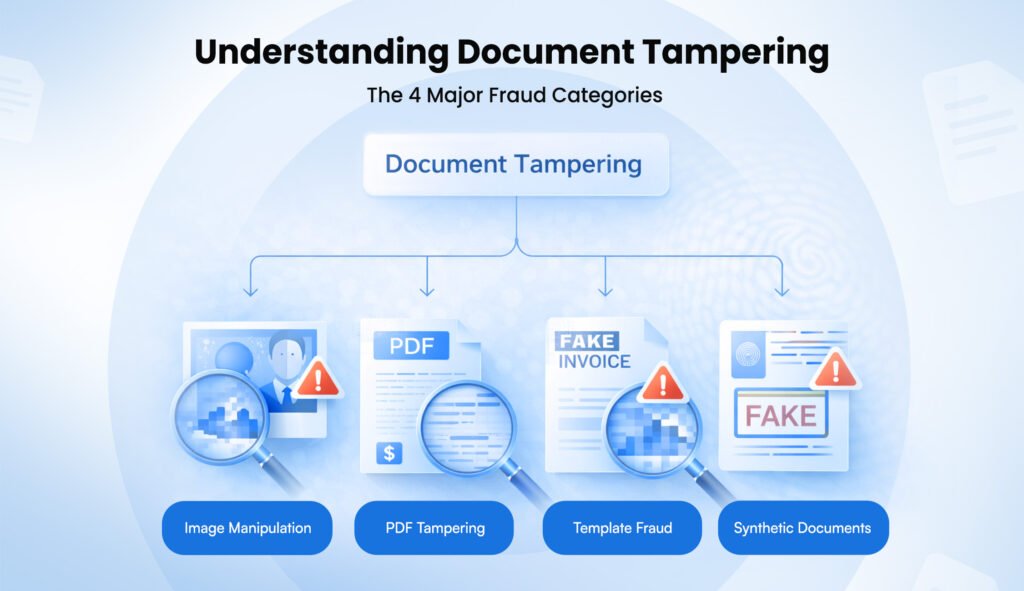

Understanding Document Tampering: The 4 Major Fraud Categories

Fraudsters employ increasingly sophisticated techniques to manipulate documents. Understanding these methods helps organizations build better defenses.

1. Digital Image Manipulation

Criminals use image editing software to alter scanned documents. They change dates on invoices, modify amounts on bank statements, or replace photos on identity documents.

The Key Detection Methods Include:

Error Level Analysis (ELA) – When an image gets edited and resaved, the edited areas show different compression levels than untouched regions. KlearStack’s ELA detection identifies these inconsistencies automatically by revealing regions with anomalous compression artifacts.

Copy-Move Forgery Detection – Fraudsters duplicate content within the same document. A legitimate stamp gets copied and pasted multiple times. DCT coefficient analysis catches these duplications by analyzing frequency domain patterns and identifying replicated image blocks.

Image Splicing Identification – Content from one image gets pasted into another. Photo replacements in ID documents or signature forgeries through image manipulation leave detectable traces at pixel boundaries and compression levels.

2. PDF Structural Tampering

PDFs contain complex internal structures that fraudsters exploit to hide modifications. The manipulation techniques include:

- Metadata Editing – Changing creation dates, author information, and producer software signatures to mask document origins

- Transparency Layer Abuse – Using opacity to cover original content while placing new content on top

- Incremental Update Exploitation – Modifying signed documents after signature validation by appending changes to the file

- Font Inconsistencies – Mixing different font types and subsetting patterns that indicate multiple editing tools were used

Font analysis reveals many PDF forgeries. Different applications embed fonts differently. When a document shows inconsistent font subsetting or mixing of OpenType and TrueType fonts, it suggests tampering.

3. Template-Based Fraud and Serial Attacks

Template farms sell pre-fabricated fraudulent documents online. A criminal buys a fake bank statement template for $15 and customizes it with their information.

This resulted in:

- Hundreds of fraud attempts using identical document layouts

- Similar metadata patterns across multiple submissions

- Documents from single sources are uploaded repeatedly

- Organized fraud rings operating at industrial scale

Document forensics identifies template farms through pattern matching. The system compares incoming documents against databases of known fraudulent templates, detecting reused layouts and metadata signatures.

4. Synthetic Document Creation

Advanced fraudsters create entirely synthetic documents using AI tools. They generate fake IDs, utility bills, or business certificates with no source.

Detection requires analyzing document characteristics against known authentic patterns. Legitimate utility bills follow specific formatting conventions. Government IDs use particular security features. KlearStack’s AI learns these patterns and flags documents that deviate from established norms.

KlearStack’s Core Document Forensics Capabilities

KlearStack’s Document Forensics engine provides comprehensive fraud detection through multiple specialized analysis methods. Each technique targets specific tampering approaches.

PDF Structural Forensics

Font Integrity Analysis

Every PDF creation tool embeds fonts in characteristic ways. LibreOffice creates font subsets differently from Microsoft Word.

What KlearStack Examines:

- Font subsetting patterns and naming conventions

- Encoding methods and glyph identifiers

- Type mixing (OpenType, TrueType, PostScript)

- Character spacing and kerning consistency

The system builds a profile of how fonts should appear in legitimate documents from specific sources. Deviations trigger forensic alerts with exact locations of inconsistencies.

Transparency Layer Detection

Criminals often use transparency to hide original content. They place opaque boxes over text, then add new content on top.

Our forensics engine examines all PDF layers and Optional Content Groups. It identifies hidden content, checks for failed redactions, and flags documents where transparency masks original information. This catches “black box” redactions that don’t actually remove underlying text.

Incremental Update Chain Analysis

The Process Works as Follows:

Step 1: Document Structure Parsing – The system reads the PDF’s internal roadmap, identifying all saved layers and object references within the file structure.

Step 2: Merkle Tree Construction – Each page’s content stream gets divided into 256-byte segments. Individual hashes and root hashes get generated for every page.

Step 3: Revision Chain Reconstruction – The forensics engine traces every modification, identifying when text changed, when images were replaced, and when metadata got altered.

Step 4: Post-Signature Validation – For signed documents, the system detects any modifications made after signature application, even when the signature remains technically valid.

This enables the precise location of alterations down to specific byte segments. When changes occur, the system knows exactly what changed and where.

Image-Level Forensic Checks

Error Level Analysis (ELA)

ELA detects image manipulations by analyzing JPEG compression artifacts. When someone edits part of an image and resaves it, the edited area gets compressed differently.

KlearStack’s ELA implementation applies controlled recompression to suspicious documents. It then compares compression levels across all regions. Areas showing inconsistent compression levels indicate manipulation. The system generates visual heatmaps showing exactly where edits occurred.

Noise Variance and Pattern Analysis

Digital images contain characteristic noise patterns from camera sensors or scanners. Natural images show consistent noise distribution.

Detection Capabilities:

- Pixel-level noise analysis across entire documents

- Anomalous noise pattern identification in edited regions

- Statistical irregularity detection at region boundaries

- Unnatural smoothness recognition indicating synthetic content

These signals reveal cloning operations, synthetic content, and image splicing that would be invisible to human reviewers.

DCT Coefficient Analysis

Discrete Cosine Transform analysis examines JPEG images in the frequency domain. Double compression leaves distinctive fingerprints in DCT coefficients.

When an image gets compressed, edited, and then compressed again, the DCT histogram shows characteristic double-quantization artifacts. KlearStack’s DCT analysis identifies these patterns automatically. It detects splicing operations where content from different sources gets combined.

Copy-Move Detection

Copy-move forgery involves duplicating regions within the same document. Fraudsters use this to replicate stamps, forge signatures, or hide unwanted content.

Our AI-Powered Detection Uses:

- Efficient block-matching algorithms for region comparison

- Deep learning models for transformation detection

- Rotation, scaling, and mirroring identification

- Pixel-perfect accuracy in identifying duplicated regions

The system generates reports showing original and copied regions with forensic-grade precision.

Text Spacing and Edge Consistency

Manual text overlays create spacing irregularities. When fraudsters add text to scanned documents, the kerning and line spacing don’t match the native document text.

KlearStack measures character spacing, line heights, and font rendering across documents. It identifies text added after scanning by detecting spacing anomalies and edge sharpness differences. This catches date changes, amount modifications, and name replacements on official documents.

Industry-Specific Use Cases: Real-World Applications

Banking and Financial Services

Banks process thousands of identity documents, proof-of-address documents, and financial statements daily for account opening and KYC compliance.

In 2024, financial institutions experienced the most fraud related to debit cards and checks, with check fraud accounting for 30% of losses and counterfeit checks being a primary driver (ABA Banking Journal and Federal Reserve Financial Services).

Document Forensics Validates:

| Document Type | Fraud Detection Focus | Forensic Method Applied |

| Identity Documents | Photo replacement, date alteration | ELA, edge consistency analysis |

| Bank Statements | Amount modification, balance inflation | PDF structural forensics, font analysis |

| Utility Bills | Template farms, address changes | Pattern matching, metadata examination |

| Proof of Income | Fabricated pay stubs, tax return alterations | Copy-move detection, DCT analysis |

The technology cross-references documents against fraud databases. It identifies serial fraud patterns where the same forged document appears across multiple applications. This catches organized fraud rings operating at scale.

Lending and Mortgage Processing

Loan applications require extensive documentation income verification, employment letters, tax returns, and property valuations.

Fraudsters alter these documents to secure loans they don’t qualify for. Research shows 56% of financial organizations lost more than $500,000 to fraud in the last 12 months, with 25% losing over $1 million (PR Newswire).

KlearStack’s forensics engine validates every document before credit assessment begins.

The Validation Process:

- Document intake and format classification

- Multi-layer forensic analysis application

- Cross-reference against known fraud patterns

- Confidence score calculation and verdict generation

- Forensic evidence compilation for decision support

For mortgage lenders, the technology validates property documents, appraisal reports, and title documents. It ensures valuations haven’t been altered and property ownership documents are authentic.

Insurance Claims Processing

Insurance fraud costs the industry $300 billion annually in the US alone. Fraudsters submit falsified invoices, altered medical reports, and duplicated claim documents.

Document Forensics Analysis:

- Invoice manipulations and duplicate receipt detection

- Medical report alterations and fabricated documentation

- Damage claim photo authenticity verification

- Document reuse patterns across multiple claims

The technology creates tamper-proof audit trails. Every document validation creates a forensic record with detailed evidence. This supports fraud investigations, legal proceedings, and regulatory reporting.

Digital Onboarding and KYC

Customer onboarding requires identity verification, address proof, and credential validation. Speed matters—customers expect instant approval. Security matters—regulators demand robust verification.

KlearStack validates identity documents in under 3 seconds. It detects photo replacements, date alterations, and synthetic identity documents. The system checks for document reuse across multiple applications and identifies template farms.

For Compliance Teams:

Every rejection includes forensic evidence showing exactly what triggered the alert. The technology provides explainable AI verdicts supporting regulatory reporting and audit requirements. Organizations demonstrate due diligence through auditable forensic records.

Vendor and Supplier Onboarding

B2B onboarding requires validating business certificates, incorporation documents, tax registrations, and insurance certificates.

Document forensics authenticates every vendor document. It validates business registration certificates against known legitimate patterns. It detects altered insurance documents and fabricated tax certificates. This protects supply chains and prevents vendor fraud before procurement relationships begin.

The Business Impact: Measurable Results

Challenge 1: Direct Fraud Losses

The Problem: Organizations lose millions to document fraud annually. Traditional verification misses sophisticated forgeries. Detection happens after money leaves the organization.

The Solution: Document forensics stops fraud at intake. Organizations like Habito detected 32% incremental fraud compared to existing solutions and reduced fraud investigations by 52 minutes per case. Prevention costs significantly less than remediation.

The Outcome: Fraud losses decrease by 30-50%. Investigation costs drop substantially. Regulatory penalties are avoided through proactive prevention.

Challenge 2: Manual Review Bottlenecks

The Problem: Trained reviewers spend hours examining documents for fraud indicators. They still miss sophisticated forgeries. Processing speeds lag customer expectations.

The Solution: Document forensics automates verification while improving accuracy. Staff focus on genuine exception cases rather than routine verification.

The Outcome: Organizations reduce manual review workload by 50-80%. Processing speeds increase from days to minutes. Staff capacity redirects to higher-value activities.

Challenge 3: Compliance and Regulatory Pressure

The Problem: Regulators demand robust KYC and AML processes. Organizations struggle to provide auditable evidence of thorough verification. Manual processes lack consistent documentation.

The Solution: Document forensics generates reports for compliance teams showing verification methods, findings, and decision rationale.

The Outcome: Regulatory examinations pass with forensic evidence. Organizations demonstrate due diligence. Penalties for inadequate verification get avoided.

Challenge 4: Customer Experience Friction

The Problem: Legitimate customers wait days for manual review. False positives create unnecessary friction. Abandonment rates increase during lengthy onboarding.

The Solution: Document forensics validates authentic documents in seconds. AI-powered analysis distinguishes between legitimate variation and actual fraud.

The Outcome: Approval times drop from days to minutes. False positive rates decrease. Customer satisfaction increases while security improves.

How KlearStack’s Document Forensics Works: Technical Implementation

The Multi-Stage Analysis Pipeline

Stage 1: Classification and Routing

The forensics engine classifies document type and format upon intake. PDFs follow the structural forensics path. Images and scanned documents follow the pixel-level analysis path. Multi-page documents get examined page by page with individual analysis results.

Stage 2: Format-Specific Forensic Application

For PDFs: metadata examination, font analysis, transparency layer detection, incremental update reconstruction

For Images: ELA processing, noise variance analysis, DCT coefficient examination, copy-move detection

For Both: text spacing verification, edge consistency checks, template matching, fraud database cross-referencing

Stage 3: AI-Powered Result Aggregation

The AI aggregates findings across all forensic methods. It assigns confidence scores to each potential issue. The system combines multiple weak signals into strong fraud indicators. This reduces false positives while maintaining high detection rates.

Stage 4: Verdict Generation

The engine generates an authentication verdict: Trusted (proceeds to extraction), Warning (flagged for human review), or High Risk (rejected with forensic evidence). Each verdict includes detailed explanations and visual evidence.

Explainable AI and Forensic Evidence

Every verdict includes detailed explanations showing exactly what triggered alerts. The system highlights suspicious regions in documents. It provides technical evidence supporting conclusions.

For Rejected Documents:

The platform generates forensic reports suitable for legal proceedings. These reports include visual evidence, technical analysis, and confidence scores. Organizations can share these reports with customers, auditors, or law enforcement.

The explainability meets regulatory requirements. Financial regulators increasingly demand transparency in automated decision systems. KlearStack’s forensics provides audit trails showing how every verdict was reached.

Integration and Deployment

The Integration Process:

- API endpoint configuration in existing workflows

- Document submission via REST API

- Real-time forensic analysis execution

- Structured JSON response with verdict and evidence

- Automated routing to extraction or rejection

The API accepts documents in multiple formats—PDF, JPEG, PNG, TIFF. It returns structured responses with verdicts and evidence. Response times remain under 3 seconds regardless of load.

For organizations using KlearStack’s full IDP platform, forensics integrates natively. Documents flow automatically from forensic validation to data extraction. Rejected documents never reach extraction systems.

Continuous Learning and Adaptation

Fraud tactics evolve constantly. Static detection rules become obsolete quickly.

KlearStack’s AI Continuously:

- Learns from new fraud patterns automatically

- Updates detection models without manual intervention

- Adapts to emerging tampering techniques

- Incorporates human feedback from reviewer overrides

- Improves accuracy through feedback loops

Organizations can customize detection thresholds based on risk appetite. Some prioritize catching every potential fraud. Others prioritize customer experience and accept higher risk. The platform adapts to these preferences through configurable sensitivity settings.

Why Should You Choose KlearStack for Document Forensics?

Financial institutions need reliable solutions for document authentication. Your current verification systems might catch obvious forgeries but miss sophisticated manipulations.

All-in-One Platform Integration

KlearStack combines document forensics with intelligent document processing. You don’t need separate vendors for authentication and extraction.

Platform Capabilities:

- Template-free processing adapting to any document format

- Self-learning AI improving with each processed document

- Automated model training without manual configuration

- Seamless integration between forensics and extraction

- Unified vendor management and support

Industry-Leading Performance Metrics

Processing Speed: Handle 10,000+ documents daily with consistent accuracy and under 3-second validation times per document. Your fraud detection scales with business growth without adding staff or infrastructure.

Multi-Format Support: Process PDFs, images, scanned documents, and mobile uploads without format conversion or preprocessing. The platform handles any document type your customers submit through any channel.

Accuracy Guarantee: Achieve 99% detection accuracy across all forensic methods while maintaining low false positive rates. Legitimate customers get approved fast. Fraudulent documents get stopped reliably without business disruption.

Key Forensic Capabilities

Dual-Layer Analysis – Combining PDF structural forensics with image-level checks catches tampering other systems miss. Incremental update detection reveals post-signature modifications invisible to standard validators.

Template Farm Identification – Stop serial fraud attacks before they scale. Cross-referencing against fraud databases blocks known fraudulent patterns. Your organization benefits from collective fraud intelligence.

Intelligent Field Extraction – Automated data validation cross-checks extracted information for consistency. Secure document handling meets banking standards and regulatory requirements across all processing stages.

Smart fraud detection needs smart solutions. KlearStack reduces your document processing time by 80% while eliminating fraud risk. The platform provides forensic-grade evidence supporting every decision.

Ready to transform your document fraud prevention? Book a Free Demo Call and see how KlearStack’s Document Forensics protects your business.

Conclusion

Document fraud costs organizations billions annually while eroding customer trust and triggering regulatory penalties. Traditional verification methods cannot keep pace with sophisticated tampering techniques.

KlearStack’s Document Forensics engine changes this equation. The platform combines PDF structural analysis with pixel-level image forensics to detect tampering invisible to human reviewers. Organizations stop fraud at intake rather than discovering it after damage occurs.

The Four Critical Business Impacts:

Financial Protection – Prevent fraud losses before they occur rather than investigating after the fact. Stop millions in potential losses through proactive document authentication at intake.

Operational Efficiency – Reduce manual review workload by 50-80% while improving detection accuracy. Reallocate staff to higher-value activities instead of routine document verification.

Regulatory Compliance – Provide auditable forensic evidence supporting all document verification decisions. Demonstrate due diligence to regulators through comprehensive audit trails.

Customer Experience – Deliver faster approval times for legitimate applications without compromising security. Reduce false positives and friction in onboarding processes.

The technology adapts continuously. AI learns new fraud patterns automatically. Detection methods evolve as tampering techniques advance. Organizations stay protected against emerging threats without manual rule updates or system reconfigurations.

FAQs

KlearStack’s Document Forensics validates PDFs, scanned images, mobile uploads, and various document formats including identity documents, financial statements, invoices, and business certificates. The system handles any document requiring authentication for business decisions. It processes documents from any source including web uploads, mobile apps, email attachments, and API submissions.

Standard verification checks if documents are readable and extractable without validating authenticity. Document forensics validates authenticity by analyzing structural integrity and detecting tampering at pixel and structural levels. It examines PDF internals, compression artifacts, and manipulations. The technology identifies forgeries that pass visual inspection and manual review.

Yes, document forensics detects AI-generated documents through pattern analysis and anomaly detection against authentic document characteristics. The system identifies synthetic content by analyzing document characteristics that AI generators cannot perfectly replicate. It flags documents showing AI generation signatures including unnatural consistency, template-based structures, and deviation from legitimate formatting patterns.

KlearStack processes documents through complete forensic analysis in under 3 seconds per document regardless of document complexity or format. The system scales to handle thousands of documents simultaneously without degrading performance or accuracy. Organizations integrate real-time validation into customer-facing workflows without adding latency or creating bottlenecks in onboarding processes.