Intelligent document processing for insurance has moved from a niche experiment to a core stack item. The global intelligent document processing market was valued at USD 2.3 billion in twenty-twenty-four, with strong growth expected over the next decade (source: Global Market Insights Inc.).

In India alone, the intelligent document processing market reached USD 80 million the same year, and projections show steep growth ahead (cited by IMARC Group).

McKinsey & Company estimates that more than 50% of current claims activities could be automated by twenty-thirty, changing how insurers handle documents end-to-end.

- Are your claims, policy, and pricing teams still re-keying data from emails, PDFs, and scans?

- Do complex packs of claims forms, proofs, and reports slow down payouts and recovery?

- Are you confident that manual checks catch document errors and fraud across every claim and policy?

Research from Wipro shows that 81% of insurers plan to raise AI spending, with AI’s share of IT budgets expected to rise from eight to twenty percent in a few years.

Intelligent document processing (IDP) sits at the center of this shift because it helps insurers read, classify, and validate documents at scale across claims, underwriting, onboarding, and policy servicing.

This article explains how intelligent document processing for insurance works, where it brings the most value, and how platforms like KlearStack support real teams, not just pilot projects.

Key Takeaways

- Intelligent document processing for insurance reads and understands multi-format documents using OCR, NLP, and machine learning.

- IDP connects directly to claims, policy, and billing systems so that validated data flows into core platforms without re-typing.

- Claims, underwriting, and onboarding teams use IDP to shorten case handling, lower backlogs, and cut follow-up loops with customers.

- Insurers gain better control over pricing, reserves, and fraud risk because document data is more complete and consistent.

- IDP is not only for large carriers; mid-size insurers can start with targeted use cases and expand as value becomes clear.

- KlearStack focuses on template-free extraction and self-learning models, which suit varied insurance documents and layouts.

- A structured roadmap that starts with one or two high-impact journeys keeps IDP projects practical and easier to adopt.

What Is Intelligent Document Processing For Insurance?

Intelligent document processing for insurance is the use of AI, OCR, and NLP to read, classify, and extract data from insurance documents. It treats claims forms, medical reports, policy documents, and emails as data sources, not just images or attachments.

Instead of staff reading each page, IDP models pick out fields such as policy numbers, dates of loss, premium amounts, and diagnosis codes. The platform then validates this data against rules, reference tables, and core systems before passing it forward.

The main building blocks of IDP in insurance are:

- Document capture: Collects files from portals, email inboxes, scanners, and third-party feeds.

- Classification: Groups documents into types such as claim form, invoice, KYC form, or endorsement.

- Data extraction: Pulls out key fields, including free-text notes and structured codes.

- Validation: Checks data against business rules and external databases.

- Integration: Sends clean data to claims, policy, billing, and analytics systems.

This view of IDP sets the stage for understanding how it actually works inside an insurance workflow, from the moment a document arrives until it is safely stored and audited.

How Intelligent Document Processing Works In Insurance?

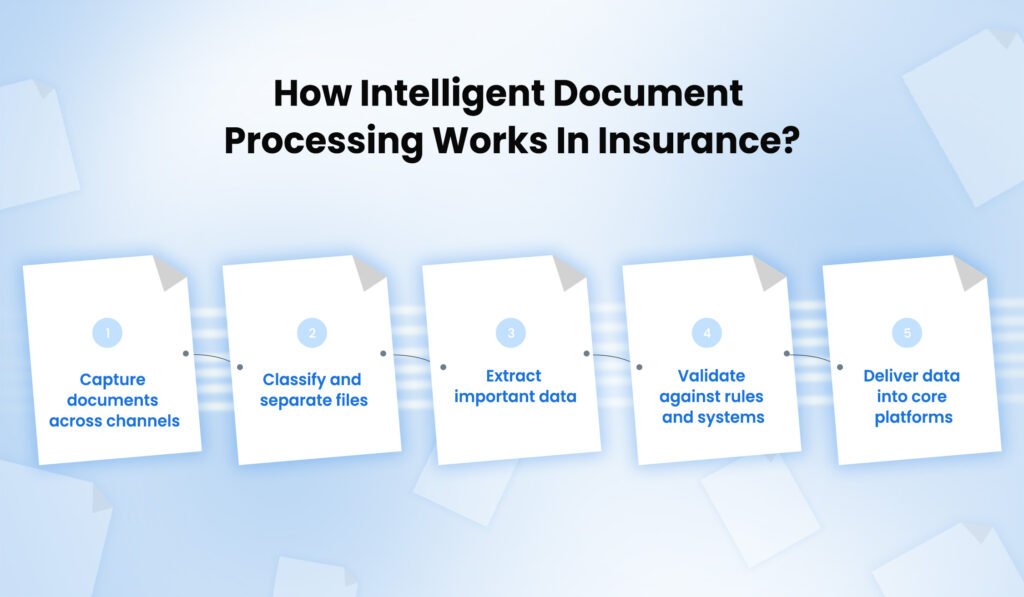

IDP in insurance follows a clear path from intake to decision. Each stage reduces manual work while keeping control of operations and risk teams.

The key steps involved are:

- Step one: Capture documents across channels

Documents arrive from agents, customers, hospitals, garages, brokers, and partners. IDP captures them from inboxes, portals, mobile uploads, and legacy queues without changing how users submit information. - Step two: Classify and separate files

The platform separates mixed document packs, identifies their type, and links them to the right claim, policy, or customer record. Misfiled pages can be flagged for review instead of getting lost. - Step three: Extract important data

OCR converts images into text, while NLP and machine learning pick out fields such as loss type, coverage limits, provider details, and bank information. The system handles typed, scanned, and many handwritten documents. - Step four: Validate against rules and systems

Business rules check dates, coverage status, policy terms, and pricing boundaries. IDP compares extracted values with policy admin, claims, and third-party data sources and raises clear exceptions where something looks wrong. - Step five: Deliver data into core platforms

Finally, structured and validated data flows into claims systems, policy administration, rating engines, or collections tools. Operations teams see status dashboards and can intervene wherever human judgment is needed.

When these steps work together, claims handlers, underwriters, and finance teams spend more time on decisions and less time moving data between screens. The next sections explore what this means for insurers in real terms.

Key Benefits For Insurers

Insurers do not adopt IDP only for technical interest; they want a visible impact on claims, servicing, and pricing. Intelligent document processing for insurance improves three main areas: speed, accuracy, and control over risk.

To make these gains clear, the table below compares manual handling with IDP-driven handling across common dimensions.

| Area | Manual Handling In Insurance | With Intelligent Document Processing |

| Intake and triage | Staff sort emails and attachments one by one | Documents auto-routed by type, source, and priority |

| Data quality | Frequent re-keying errors and missing fields | Standardized data with clear exception queues |

| Turnaround time | Long queues before assessment begins | Cases are ready for assessment soon after arrival |

| Compliance and audit | Hard to track who touched which document and when | Full audit trail with timestamps and validation checks |

| Reporting and insight | Fragmented data exported into spreadsheets | Central dataset ready for pricing, reserving, and risk |

Beyond this, IDP helps insurers:

- Handle peaks without constant hiring: Volume spikes from natural events or campaign pushes are easier to manage.

- Reduce back-and-forth with customers and partners: Fewer missing fields mean fewer follow-up calls and emails.

- Support new digital journeys: Self-service portals and apps rely on clean document data to keep processes moving.

These benefits become more concrete when mapped to specific use cases across claims, underwriting, onboarding, and policy administration.

Core Use Cases In Insurance

Intelligent document processing for insurance touches many parts of the value chain. Rather than trying to cover everything at once, it helps to focus on core journeys where document work is heavy and repeatable.

Claims Processing

Claims teams often handle large packs of forms, evidence, medical records, garage invoices, and correspondence. IDP helps by:

- Extracting loss details and coverage data from claim forms and emails.

- Matching invoices, reports, and photos to the right claim record.

- Flagging inconsistencies that may hint at fraud or mis-keyed details.

This reduces case set-up delays and gives handlers better information when speaking with customers or partners.

Underwriting And Pricing

Underwriting teams must read proposals, prior policies, inspection reports, and financial statements. With IDP:

- Risk factors and exposure details are pulled from unstructured documents into rating models.

- Past claims history and endorsements are linked automatically to new submissions.

- Exceptions where documents do not match declarations are highlighted for review.

The result is more consistent pricing decisions and clearer documentation for audits and regulators.

Customer Onboarding And KYC

Onboarding involves ID checks, income proofs, bank details, and regulatory forms. IDP helps by:

- Reading ID documents, address proofs, and bank statements across varied formats.

- Checking that submitted documents match customer declarations and internal records.

- Feeding verified KYC data into policy and billing systems without extra typing.

This keeps onboarding moving while still respecting KYC and AML expectations.

Policy Servicing And Administration

Endorsements, renewals, and cancellations also trigger document flows. IDP can:

- Extract changes from endorsement requests and apply them to policy records.

- Read broker correspondence and attach it to the right policy and account.

- Support straight-through processing for simple renewals or address changes.

Together, these use cases build a strong business case for IDP in insurance, making the next question less about why and more about how to adopt it properly.

Technology Behind Intelligent Document Processing

Under the hood, intelligent document processing for insurance relies on several technologies working together. The goal is not just text extraction, but understanding and validation in a way that suits insurance language and layouts.

- Optical Character Recognition (OCR)

OCR converts scanned images and PDFs into machine-readable text. Modern OCR engines handle mixed fonts, low-quality scans, and multi-column layouts. For insurance, this matters for hospital invoices, handwritten claim forms, and legacy policy schedules.

- Natural Language Processing (NLP)

NLP helps the system understand free-text notes, email bodies, and descriptions in reports. It can spot dates of loss, causes of damage, liability statements, and coverage wording, even when they appear in narrative form instead of fixed boxes.

- Machine Learning Models

Machine learning models learn from past documents and user corrections. Over time they:

- Improve field detection on complex forms and variable layouts.

- Learn which patterns suggest potential fraud or misrepresentation.

- Adapt to new document templates without manual re-configuration.

- Integrations And Orchestration

IDP platforms connect with claims, policy admin, CRM, core banking, and content management systems. They orchestrate hand-offs between capture, extraction, validation, and posting, often using APIs and event queues.

With this technical base in mind, insurers still need a practical path to bring IDP into live operations. That is where a clear roadmap helps.

Building An IDP Roadmap For Insurance Teams

Jumping straight into a large IDP rollout often leads to stalled pilots. A structured roadmap keeps projects grounded in real business value and adoption.

A practical approach uses these stages:

- Stage one: Choose one or two high-impact journeys

Many insurers start with claims intake for a specific product line or with KYC for a single region. The focus is on journeys where document pain is visible and metrics are easy to track. - Stage two: Define target documents and rules

Operations and risk teams list document types, priority fields, and validation rules. This avoids gaps where important fields are not captured or checked. - Stage three: Run a controlled pilot with clear baselines

A small group of users tests the platform against real traffic. They compare handling time, error levels, and exception rates with the old process. - Stage four: Expand to adjacent journeys

Once one journey stabilizes, insurers extend IDP to nearby areas, such as moving from auto claims to property, or from onboarding to renewals.

This staged roadmap works best when supported by a platform that can learn from corrections and handle new document types without long re-builds. That is where KlearStack fits in.

Why Should You Choose KlearStack For Intelligent Document Processing In Insurance?

Insurance carriers and insurtechs need more than basic OCR. They need a platform that handles varied document formats, complex rules, and strict governance. KlearStack is designed around these needs.

We focus on template-free extraction, so new claim forms, policy layouts, or partner documents do not require fixed templates. Self-learning models pick up patterns from user corrections, which helps the system improve across claims, underwriting, and servicing.

Key capabilities that matter for insurance teams include:

- Support for end-to-end journeys: From capture and classification to validation and posting into core systems.

- Strong handling of mixed document packs: Claims, evidence, reports, and correspondence can be split, merged, and routed correctly.

- Configurable rules and checks: Business users define rules for coverage, limits, and pricing so that the platform fits existing policies.

- Built-in audit trails and access controls: Every change and review is logged, supporting internal audit and regulatory reviews.

KlearStack can sit alongside existing claims and policy platforms, adding intelligent document processing without forcing a large system replacement. For insurers aiming to cut manual document work while keeping risk in check, this balance is important.

Still got questions? Bring your documents to a Live Demo for Free and see KlearStack in Action!

Conclusion

Intelligent document processing for insurance turns unstructured documents into reliable, usable data across claims, underwriting, onboarding, and servicing. When done well, it shortens case handling, reduces rework, and gives finance and risk teams a clearer view of exposure and reserves.

For insurers, the next step is choosing a practical starting point and a platform partner that understands insurance documents in depth.

FAQs

Intelligent document processing for insurance uses AI to read, classify, and extract data from claims, policies, and related documents. It replaces manual reading and typing with automated capture and validation.

Basic OCR only turns images into text. Intelligent document processing also understands context, validates fields, and connects data into claims, policy, and billing systems.

Claims intake, underwriting, customer onboarding, and policy servicing gain the most value. These areas involve large document volumes, repeated steps, and many checks that IDP can handle.

KlearStack offers template-free extraction, self-learning models, and strong insurance-ready rules. It fits varied document types and integrates with existing claims and policy platforms without large process changes.