Introduction: Why Mortgage Document Processing Still Slows Down Lending

For many lenders, the most painful part of the loan journey is not underwriting or pricing. It is the tedious flow of pay stubs, bank statements, tax returns, KYC forms, and property papers that must be collected, checked, and re-checked before a loan can be approved.

Industry research shows that a typical mortgage application still takes around 30–40 days to move from application to disbursement, largely because of manual document work.

At the same time, nearly 90% of lenders believe technology can improve the mortgage application process, especially by cutting document-related friction.

Borrowers are just as impatient. In one well-known survey, 58% of borrowers said the availability of an online application would influence their choice of lender, and most expect quick, digital updates rather than repeated branch visits. Yet 68% of borrowers still spend half an hour or more just filling out the application, not counting back-and-forth document requests.

If you are running a bank, NBFC, or housing finance company in India or abroad, you probably recognise questions like:

- Why does it take weeks to validate one mortgage file when all the data already exists on documents?

- Why do underwriters still re-check income, identity, and property documents manually before every approval?

- Why are fraud flags, missing papers, and compliance issues often discovered late in the process instead of at first review?

This guide explains what mortgage document processing looks like today, how AI-driven Intelligent Document Processing (IDP) changes the picture, and where a platform like KlearStack fits in.

Key Takeaways

- Mortgage document processing is the document-heavy middle of the loan journey where most delays, rework, and risk appear.

- Modern IDP platforms read, classify, and validate high-volume mortgage documents without template maintenance.

- AI models can highlight fraud and risk patterns early, before files reach underwriters or auditors.

- Indian and global lenders can connect IDP into existing LOS and core systems instead of rebuilding tech stacks.

- KlearStack gives operations teams a practical way to reduce manual work while retaining full control over credit policy and checks.

Key Steps In Mortgage Document Processing

Mortgage document processing is the set of steps that convert raw borrower paperwork into a clean, decision-ready file. In a typical bank or HFC, this work sits between application capture and underwriting.

In many teams, these steps are still run on spreadsheets and shared folders. That is where delays, errors, and audit gaps creep in.

End-To-End Workflow

- Document Collection And Intake

Branch staff, relationship managers, or digital portals collect pay stubs, bank statements, tax forms, ID proofs, property papers, and declarations. - Classification And Sorting

Documents are manually labelled by type, product, and borrower so they can be routed for checks. - Data Extraction

Key fields such as income, balances, loan amounts, tenure, and PAN numbers are keyed into LOS or core systems. - Verification And Cross-Checks

Teams confirm that income, identity, property, and collateral details match internal rules and external databases. - Condition Management

Exceptions, missing documents, and clarifications are tracked across email threads and informal lists. - Fraud And Risk Review

Analysts check for altered statements, inconsistent ownership, and suspicious transaction patterns. - File Preparation For Underwriting

Once documents are complete and checked, a final package is created for underwriters or credit committees.

Where The Bottlenecks Usually Sit

Most delays occur in three areas:

- Data entry and re-entry across LOS, credit tools, and core banking systems.

- Chasing missing documents from borrowers or channel partners.

- Rework after audit findings when something was mis-keyed or not checked early enough.

An AI-driven approach does not replace credit judgement. It removes the repetitive, error-prone handling that slows every file down.

Role Of Automation And AI In Mortgage Document Processing

Automation and AI change mortgage document processing from “files and folders” to “data and workflows. The aim is simple: documents should arrive in the underwriting stage already clean, complete, and validated.

How IDP Fits Into The Mortgage Stack

In a modern stack, an IDP platform sits between intake channels and your LOS or core systems:

| Layer | What It Handles |

| Front-End Channels | Branch upload, DSAs, portals, mobile apps, email intake |

| IDP Platform (KlearStack) | Capture, classification, data extraction, validation, fraud and quality checks |

| Downstream Systems | LOS, CRM, credit engines, collections, archival repositories |

The IDP layer removes manual reading and typing. It also provides a single rules engine for document-level checks across products and geographies.

What AI Actually Does Here

Within mortgage document processing, AI models can support teams in several ways:

- Document Type Detection – Automatically identify payslips, bank statements, sanction letters, KYC forms, property papers, and more from mixed batches.

- Field-Level Extraction – Capture income figures, EMI amounts, account numbers, IFSC codes, and addresses from both structured and unstructured layouts.

- Pattern Analysis – Flag unusual income jumps, frequent cash deposits, or round-number transfers that may need additional review.

- Consistency Checks – Compare borrower names, PAN or SSN, and property details across different documents and highlight mismatches.

- Learning Over Time – Improve accuracy as more mortgage files are processed, without teams having to build or maintain templates.

For CXOs, the biggest advantage is predictability: once every file passes through the same intelligent checks, early-stage leakage and downstream surprises reduce sharply.

Typical Documents In Mortgage Files

Every lender has its own checklist, but the broad categories remain similar across India, the US, and other markets.

Core Document Buckets

- Identity And Address Proof

Passports, Aadhaar cards, driver’s licences, voter IDs, and utility bills. - Income And Employment Proof

Pay stubs, salary certificates, Form 16, tax returns, and employment letters. - Banking And Liability Statements

Current account statements, loan statements, credit card statements, and bureau reports. - Property And Collateral Papers

Sale deeds, title reports, encumbrance certificates, valuation reports, and insurance documents. - Product-Specific Forms

Application forms, declarations, consent forms, sanction letters, and disbursement requests.

Why Manual Handling Fails At Scale?

Manually processing these documents creates recurring issues:

- Different formats from employers, banks, and registrars.

- Mixed quality scans from branches, DSAs, and customers.

- Local language content in Indian markets that generic tools cannot read reliably.

An IDP platform that is trained on domain-specific documents can handle all of these variations while keeping exceptions visible to operations and risk teams.

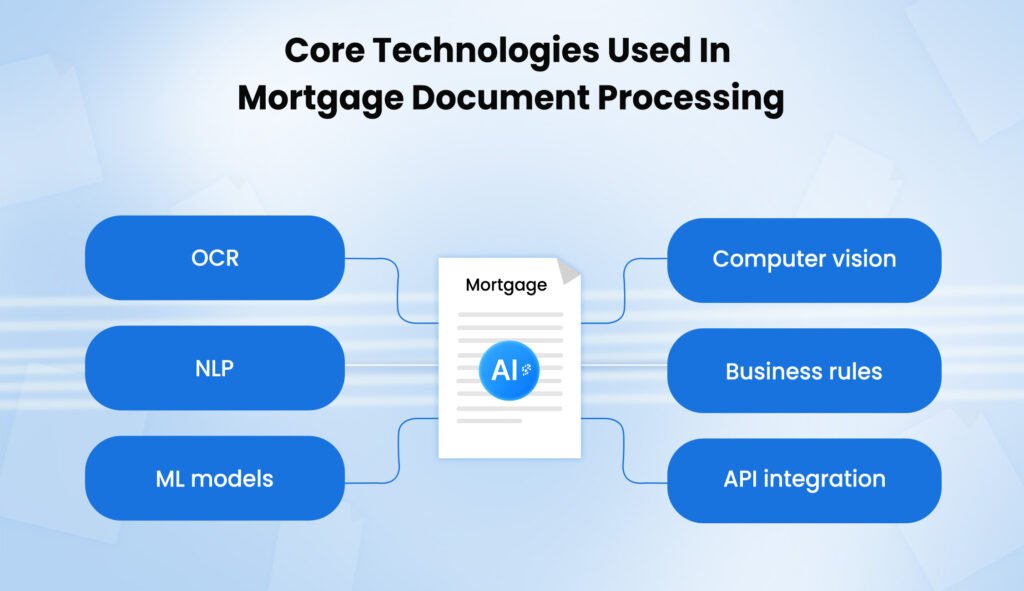

Core Technologies Used In Mortgage Document Processing

Under the hood, modern mortgage document processing sits on a mix of mature and advanced technologies.

The Technology Stack

- Optical Character Recognition (OCR)

Converts scanned statements and images into machine-readable text. - Natural Language Processing (NLP)

Understands free-form content such as remarks, descriptions, and narrative sections in credit reports or valuation notes. - Machine Learning Models

Learn from past mortgage files to predict document types, correct reading errors, and improve extraction accuracy. - Computer Vision

Detects stamps, signatures, and visual tampering such as overwriting or cut-and-paste activity. - Business Rules And Validation Engines

Map lender policies into programmatic checks, from LTV thresholds to acceptable income patterns. - API-Level Integration

Connects the IDP engine with LOS, CBS, CRM, and external data sources like bureau reports or KYC registries.

What This Means For CXOs?

You do not need to assemble this stack yourself. The practical question is whether your chosen platform can:

- Support regional languages and mixed-quality scans.

- Keep improving without constant template maintenance.

- Provide auditable logs for every extracted field and automated check.

These are the capabilities that matter more than the underlying jargon.

Benefits Of Mortgage Document Processing Automation For Lenders

When document processing becomes data-driven, the impact is visible across the lending lifecycle.

Business Outcomes That Matter

- Shorter Cycle Times

Files move from application to underwriting faster because most checks are handled at intake. - Lower Operational Cost Per File

Data entry teams can focus on exception handling rather than typing every number into every system. - Better Risk Control

Inconsistent or suspicious data gets flagged early, not after a loan has already been booked. - Improved Borrower Experience

Customers receive quicker responses and fewer repeated requests for the same documents. - Cleaner Audit Trails

Every document, extracted field, and rule hit is logged, making regulatory and internal audits easier.

Why This Is Especially Relevant In India

Indian lenders and NBFCs handle high volumes, complex co-applicant structures, and region-specific documents. Manual processes simply do not keep pace with growth targets.

AI-driven document processing helps teams:

- Serve tier-2 and tier-3 markets without proportionally increasing back-office headcount.

- Standardise checks across branches, DSAs, and digital channels.

- Support new digital mortgage products while staying within RBI and regulatory expectations.

Why Choose KlearStack For Mortgage Document Processing?

KlearStack is an AI-driven document intelligence platform built for high-volume, high-risk document environments such as lending and insurance. For mortgage teams, it focuses on three priorities: accuracy, control, and time-to-value.

How KlearStack Supports Mortgage Operations?

- Domain-Trained Models For Mortgage Documents

Pre-trained on payslips, bank statements, KYC documents, and property papers, with the ability to adapt to new layouts quickly. - Template-Less Extraction

New employers or banks do not require fresh templates. The platform learns from samples and feedback, which keeps maintenance overhead low. - Configurable Validation Rules

Credit, risk, and operations teams can encode their own rules for income stability, bank balance patterns, or property document completeness. - Early Fraud And Risk Flags

KlearStack can highlight altered statements, inconsistent identities, and suspicious transaction patterns before files reach underwriting. - Smooth Integration With Existing Systems

APIs and connectors make it possible to plug into LOS, core banking, and downstream analytics without major rebuilds.

Practical Value For CXOs

For business and operations leaders, this translates into:

- Predictable throughput across peak seasons.

- Better visibility on where each file is stuck and why.

- A foundation for future use cases such as income-only products, pre-approved offers, or straight-through digital mortgages.

The platform does not replace your LOS or credit engine. It strengthens the document layer that feeds both.Book a Free Demo Today to see your Mortgage Documents Processed Automatically Live!

Conclusion

Mortgage document processing is where borrower expectations, regulatory requirements, and operational realities collide. When this stage relies on manual work, cycle times stretch, risk keeps slipping through gaps, and growth targets start to feel out of reach.

AI-driven Intelligent Document Processing gives lenders another way forward. By converting unstructured mortgage documents into reliable, validated data, it lets underwriters focus on decisions rather than paperwork, and it gives CXOs confidence that growth does not come at the cost of control.

KlearStack brings these capabilities into a single, ready-to-deploy platform for banks, NBFCs, housing finance companies, and digital lenders. If you are rethinking your mortgage operating model for the next few years, the document layer is the best place to start.

FAQs About Mortgage Document Processing

Mortgage document processing is the set of activities required to collect, read, validate, and organise borrower and property documents so that a loan file is ready for underwriting and approval.

A loan origination system manages workflows, tasks, and approvals. Mortgage document processing focuses on the documents themselves: capturing them, extracting data, running checks, and feeding structured information into the LOS.

Income proofs, bank statements, tax returns, property papers, and KYC documents gain the most value because they are high volume, variable in format, and critical for risk assessment.

Yes, modern OCR and computer-vision models can handle mixed quality to a large extent. However, platforms like KlearStack still highlight low-confidence fields so humans can review them.